AMAG Austria Metall AG: Highest half-year earnings in the company’s history

- AMAG achieves record levels of revenue and earnings in the first half of 2022

- Positive market environment, sustained high productivity as well as continuous product mix optimisation prove to be decisive factors

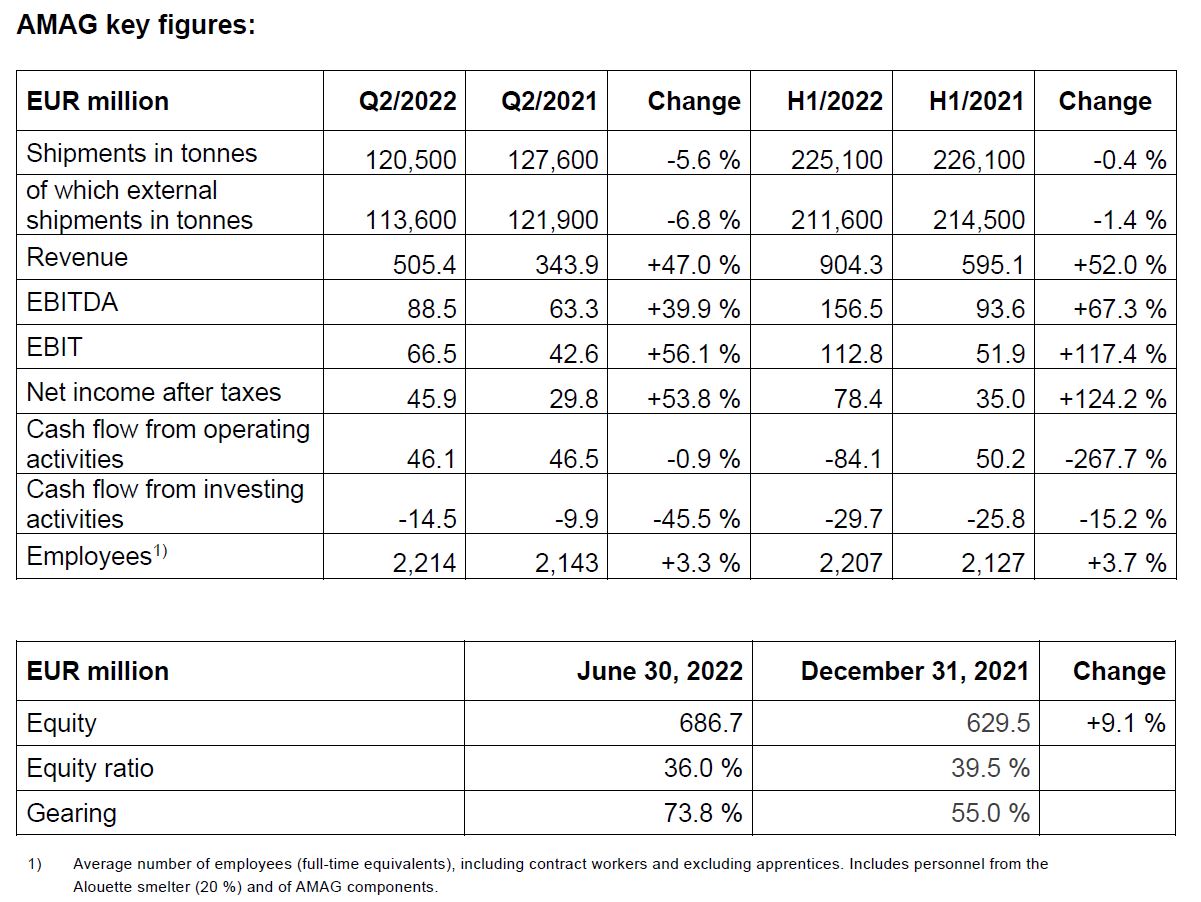

- Significant revenue growth of around 50 % to EUR 904.3 million (H1/2021: EUR 595.1 million)

- Considerable EBITDA growth of almost 70 % to EUR 156.5 million (H1/2021: EUR 93.6 million)

- Net income after taxes reflects a very successful first half of 2022 with growth of over 120 % to EUR 78.4 million (H1/2021: EUR 35.0 million)

- Outlook for 2022: EBITDA between EUR 220 million and EUR 250 million, stable energy supplies and solid market conditions provided

Following a very successful start to 2022, AMAG Austria Metall AG achieved further growth in revenue and earnings in the second quarter of 2022. With EBITDA of EUR 156.5 million in the first six months of the year under review, the AMAG Group generated its highest-ever half-year earnings.

Gerald Mayer, CEO of AMAG Austria Metall AG, comments: “Our AMAG team managed to achieve a record result with a high level of competence and great commitment. Nevertheless, the first half of the year was characterised by uncertainties in the supply of materials and energy as well as difficulties in international logistics. Provided that the energy supply is also secured in the second half of the year, we expect a very good financial year in 2022, despite the first noticeable slowdown in the economic environment.”

AMAG Group revenue increased significantly by 52.0 % to reach EUR 904.3 million in the first half of 2022 (H1/2021: EUR 595.1 million), mainly due to the higher aluminium price and the successful implementation of product mix optimisations. At 225,100 tonnes, shipment volumes were approximately at the previous year’s level (H1/2021: 226,100 tonnes).

Earnings before interest, tax, depreciation and amortization (EBITDA) grew by 67.3 % to EUR 156.5 million in the half-year under review (H1/2021: EUR 93.6 million). The significantly higher aluminium price compared with the first half of the previous year (+36.9 % to 3,088 USD/t) and attractive alumina costs strengthened the Metal Division’s earnings performance. At the Ranshofen site, high productivity and successful optimisation in the product portfolio are especially reflected in the EBITDA trend. High cost inflation, particularly in relation to energy, primary materials and logistics, was largely offset by price adjustments.

Depreciation and amortization amounted to EUR -43.7 million in the first half of 2022 (H1/2021: EUR -41.7 million). The operating result (EBIT) grew significantly by 117.4 % year-on-year and, at EUR 112.8 million, reflects a very successful half-year (H1/2021: EUR 51.9 million).

At EUR 78.4 million, net income after income taxes was 124.2 % higher than in the first half of the previous year (H1/2021: EUR 35.0 million).

Cash flow from operating activities benefited from record half-year earnings, although it also reflected increasing financing requirements for inventory. The higher working capital is particularly due to the increase in the price level and the accumulation of safety stocks. In the first half of 2022, cash flow amounted to EUR -84.1 million (H1/2021: EUR 50.2 million). Cash flow from investing activities amounted to EUR -29.7 million in the first six months of the reporting year (H1/2021: EUR -25.8 million). This results in free cash flow of EUR -113.9 million, compared to EUR 24.4 million in the previous year.

Net financial debt stood at EUR 506.8 million as of June 30, 2022, compared with EUR 346.1 million as of the end of the 2021 financial year. AMAG Group’s equity grew to EUR 686.7 million as of June 30, 2022 (December 31, 2021 EUR 629.5 million). The equity ratio stood at 36.0 % as of the end of June 2022 (December 31, 2021: 39.5 %).

Outlook for 2022:

The current market environment has deteriorated, especially due to the Ukraine conflict, and visibility is particularly limited. Although the Commodity Research Unit (CRU) reports continued growth in demand for aluminium products, its forecast depends to a great extent on how economic trends in Europe and worldwide play out. In particular, high cost inflation and the risk relating to Europe’s energy supplies are curbing the economic outlook worldwide and also impacting AMAG’s business performance. The further course of the COVID-19 pandemic may also affect economic growth. Supply chain constraints and the ongoing labour shortage will remain challenging in the second half of 2022.

In detail, earnings in Canada will depend above all on further price trends for aluminium and key raw materials. Currency fluctuations, especially between the USD and the CAD, may additionally affect earnings in the Metal Division.

Assuming that energy supplies are stable in the second half of 2022 and solid market conditions exist, the AMAG Management Board expects full-year EBITDA of between EUR 220 million and EUR 250 million for AMAG Group.