Record earnings in FY 2021 with shipment volumes returning to pre-crisis levels

- Significant growth in revenue and earnings due to stable production, highproductivity and attractive market environment in the primary aluminiumsector

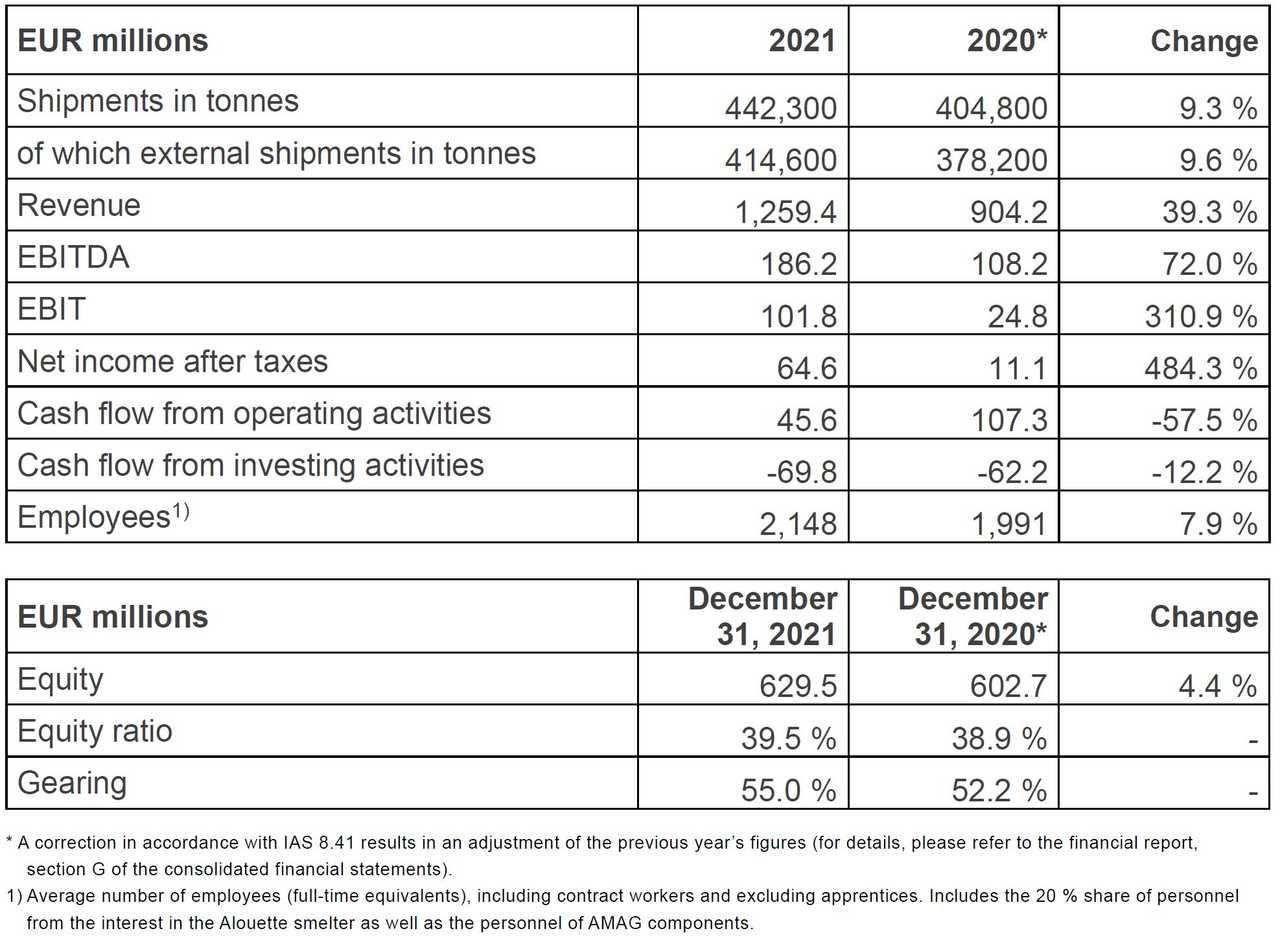

- Revenue of EUR 1,259.4 million clearly above the previous year’s level dueto increased shipment volumes and high aluminium prices (2020:EUR 904.2 million)

- EBITDA achieves significant growth of +72 % to EUR 186.2 million(2020: EUR 108.2 million)

- Net income after taxes up almost sixfold to EUR 64.6 million (2020:EUR 11.1 million*)

- Dividend proposal of EUR 1.50 per share reflects positive businessperformance

- Further highlights: New products fireworks consistently continued andpath to climate-neutral AMAG outlined

- Outlook for 2022: Demand for aluminium products continuing to rise,according to CRU. Too early for earnings guidance due to uncertain markettrend

* includes correction according to IAS 8.41 (details are explained in chapter G in the consolidated financial statements)

AMAG Austria Metall AG expanded shipment volumes in all its operating divisions in the

2021 financial year and even slightly exceeded pre-crisis levels from 2019. The positive

market environment was thereby successfully leveraged both in the primary aluminium

business and in recycled cast alloys and aluminium rolled products.

Gerald Mayer, CEO of AMAG comments: “With stable production output and high

productivity, we successfully met high demand from almost all industrial sectors. We

implemented product mix optimisations on a targeted basis at our site in Ranshofen and

successfully served existing customers. Significant cost inflation, especially for energy,

metal alloys and logistics, negatively impacted earnings and margin trends from the

second half of 2021 onwards. Our Canadian subsidiary Alouette made a significant

contribution to the AMAG Group’s record results as the particularly positive market

environment was leveraged successfully.”

Revenue of EUR 1,259.4 million clearly reflects the significantly higher aluminium price

and premium levels as well as the volume growth in the reporting year (2020:

EUR 904.2 million). The average 3-month aluminium price rose from 1,730 USD/t in the

previous year to 2,488 USD/t in the 2021 financial year (+43.8 %). Shipment volumes

recorded considerable growth across all industrial sectors and totalled 442,300 tonnes

in the 2021 financial year, compared with 404,800 tonnes in the previous year (+9.3 %).

Earnings before interest, taxes, depreciation and amortisation (EBITDA) achieved

a significant increase above 70 % to reach EUR 186.2 million, thereby resulting in a new

high in AMAG’s history (2020: EUR 108.2 million). The growth in shipment volumes in

all AMAG divisions and product mix optimisations at the Ranshofen site are major drivers

for this record. A particularly favourable market environment in the primary aluminium

area also made a significant contribution to the AMAG Group’s positive performance.

Overall, the EBITDA margin recorded a clear improvement from 12.0 % in the previous

year to 14.8 % in the year under review.

After depreciation and amortisation of EUR 84.4 million in the 2021 financial year

(2020: EUR 83.5 million), a triple-digit operating profit (EBIT) of EUR 101.8 million was

achieved, compared with EUR 24.8 million in the previous year. Net income after taxes

rose approximately six-fold year-on-year to reach EUR 64.6 million in the 2021 financial

year (2020: EUR 11.1 million).

Cash flow from operating activities amounted to EUR 45.6 million in the year under

review (2020: EUR 107.3 million). The high earnings contribution had a positive impact

on cash flow, while the significantly higher aluminium price had an offsetting effect in

relation to inventory financing (working capital). A total of EUR 69.8 million was spent on

investments in the 2021 financial year, compared with EUR 62.2 million in the previous

year. Free cash flow amounted to EUR -24.2 million as a consequence (2020:

EUR 45.1 million).

The key balance sheet figures continue to reflect AMAG’s stable position. Net financial

debt stood at EUR 346.1 million as of December 31, 2021, compared with

EUR 314.3 million as of the end of the 2020 financial year. Equity amounted to

EUR 629.5 million at the end of the year under review (December 31, 2020:

EUR 602.7 million), and the equity ratio rose from 38.9 % as of December 31, 2020 to

39.5 % as of the 2021 year-end. The gearing ratio at the end of the reporting year stood

at 55.0 % (December 31, 2020: 52.2 %).

Proposed dividend:

The Management and Supervisory boards will propose a dividend of EUR 1.50 per share

to the Shareholders’ Annual General Meeting. This corresponds to a dividend yield of

around 4 % in relation to the year-end closing price of the AMAG share of EUR 41.00.

As in the previous year, the Annual General Meeting will be held in virtual form on April

20, 2022. The dividend payment date is April 27, 2022.

Outlook:

Positive economic forecasts for 2022 with an expected global growth of +4.4 % and

+3.9 % for the Eurozone are marked by various uncertainties (e.g. supply chains

inflation, geopolitical developments). The further course of the COVID-19 pandemic,

particularly in relation to virus mutations, can exert both a rapid and significant influence

on economic growth.

Forecasts by the CRU (Commodity Research Unit) for demand for both primary

aluminium and aluminium products are promising. With a look to 2022, cross-industry

demand is expected to increase by 1.7 % and 9.7 % respectively.

The continued gratifying order book position at the Ranshofen site reflects high demand

for aluminium products and leads to the anticipation of a positive trend in shipment

volumes. However, in some cases considerable increases in key production costs will

continue to impact earnings and margin trends in the 2022 financial year. Shortages of

suitable skilled personnel and impaired supply chains remain challenging.

Gerald Mayer, CEO of AMAG: “We are confident that, after a record year in 2021, we

will again achieve good results in the 2022 financial year, despite significant cost

increases. Risks include uncertain geopolitical developments, a significant rise in

inflation and negatively impacted supply chains.”

In the primary aluminium business, earnings depend to a large extent on aluminium and

raw material prices, which can be highly volatile as experience shows. Currency

fluctuations, especially in terms of USD-CAD and EUR-USD, can also have an impact

on earnings development.

It is too early to issue earnings guidance in the form of an EBITDA range due to the

uncertainties outlined.

Annual Report 2021:

The 2021 annual report is now available for downloading from the investor relations area

of the AMAG website. It consists of the comprehensive financial report including the nonfinancial statement as well as a magazine summarising the most important information

on the 2021 business performance.