Suche

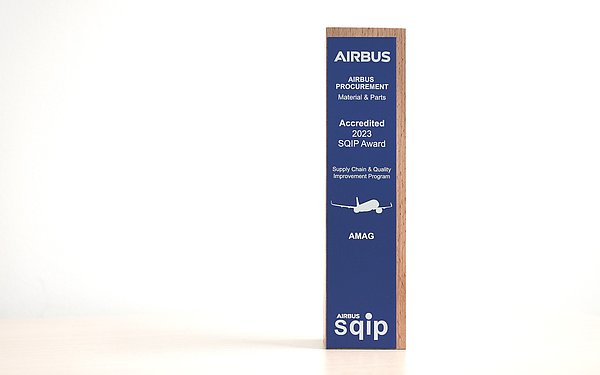

AMAG RÄUMT BEI PREISVERLEIHUNG AB: DREI BESONDERE AWARDS VON AIRBUS FÜR INNOVATION, NACHHALTIGKEIT UND QUALITÄT

- AMAG zum dritten Mal in Folge für herausragende Qualität und Liefertreue ausgezeichnet („Accredited Supplier Award“)

- Sonderpreise im Bereich Innovation und Nachhaltigkeit

- Strategische Ausrichtung der AMAG auf Innovation und Nachhaltigkeit bestätigt

GUT ZU WISSEN IM AMAG_FORUM

Vorträge im April 2024

Donnerstag, 25. April 2024 - 19:00 Uhr:

Wie die AMAG durch nachhaltiges Handeln globale Verantwortung übernimmt - Dipl.-Ing. Dr.mont. Marlis Zöhrer, Leitung Nachhaltigkeit

Eintritt frei!

IM KINDERGARTEN PISCHELSDORF AM ENGELBACH FORSCHEN DIE SPÜRNASEN

„Die Natur erforschen", so lautet seit einigen Wochen das Motto in der „Spürnasenecke" im Kindergarten Pischelsdorf. Nun erfolgte die offizielle Übergabe der speziell dafür entwickelten Möbel und Forscherutensilien aus dem MINT-Bereich. Dadurch werden Kinder bereits im frühen Alter von 3-6 Jahren vermehrt für Naturwissenschaften und Technik begeistert.

ALUREPORT AUSGABE 01/2024

"STRAHLEND..."

Die Titelseite der aktuellen AluReport-Ausgabe ziert das 2014 errichtete Warmwalzwerk in der AMAG.

Auch nach zehn Jahren glänzt die Fassade noch wie am ersten Tag - und das ohne Reinigung. Mehr über unsere hochwertigen Lösungen für oberflächensensible Produkte und viele weitere Themen finden Sie in der aktuellen Ausgabe des AluReports, unserer AMAG Kunden- und Marktinformation.

AMAG STÄRKT KOMPETENZ IM BEREICH HOCHWERTIGER OBERFLÄCHEN

- AMAG stärkt Position als Oberflächenspezialist mit moderner Bandveredelungsanlage für hochwertige Aluminium-Oberflächen

- Produkte der neuen Anlage für vielfältige Anwendungen in unterschiedlichen Branchen

- Digitalisierung für Qualität, Produktivität und Nachhaltigkeit

AMAG Austria Metall AG: Einzigartige Aufstellung ermöglichte gute Geschäftsentwicklung im Jahr 2023

- Rasche Reaktion auf Veränderungen am Markt sowie stabile operative Performance sicherten erfolgreiches Geschäftsjahr der AMAG-Gruppe

- Umsatzerlöse von 1.459,2 Mio. EUR nach Rekord im Vorjahr (1.726,7 Mio. EUR)

- EBITDA stellt mit 188,4 Mio. EUR zweithöchsten Wert in der Unternehmensgeschichte dar (2022: 247,1 Mio. EUR)

- Solides Ergebnis nach Ertragsteuern von 66,4 Mio. EUR (2022: 109,3 Mio. EUR)

- Signifikanter Anstieg im Cashflow aus laufender Geschäftstätigkeit um 110 % auf 180,9 Mio. EUR (2022: 86,1 Mio. EUR)

- Dividendenvorschlag von 1,50 EUR je Aktie

- Ausblick 2024: Ergebnisprognose in Form einer EBITDA-Bandbreite aufgrund unsicherer Markt- und Wirtschaftsentwicklung verfrüht

AMAG ERHÄLT GROSSAUFTRAG ZUR LIEFERUNG AN AUDI WERK IN GYÖR

- AMAG unterzeichnet größten Mehrjahresvertrag mit der AUDI AG in der Firmengeschichte

- Langjährige Kundenbeziehung wird damit vertieft und ausgeweitet

- Wesentlicher Beitrag zur Reduktion des CO2-Fußabdrucks durch Recycling von Aluminium-Rücklaufmaterial

AMAG ERHÄLT AUSTRIAN SUSTAINABILITY REPORTING AWARD IN BRONZE

- AMAG ausgezeichnet mit bronzenem ASRA für die besten Nachhaltigkeitsberichte österreichischer Unternehmen

- Bewertung in der Kategorie Unternehmen, deren Aktien im Prime Market der Wiener Börse notieren

- Nachhaltigkeitsberichterstattung wird in der AMAG bereits seit 2013 umgesetzt

DR. HELMUT KAUFMANN ZUM NEUEN VORSTANDSVORSITZENDEN UND MAG. CLAUDIA TRAMPITSCH ZUR NEUEN FINANZVORSTÄNDIN BESTELLT

- Dr. Helmut Kaufmann übernimmt per 1.1.2024 den Vorstandsvorsitz zusätzlich zu seiner Funktion als Technikvorstand

- Mag. Claudia Trampitsch wird ab 1.1.2024 neue Finanzvorständin der AMAG Austria Metall AG

- Stabilität in der AMAG durch Vorstand in der neuen Zusammensetzung sichergestellt

VON NACHHALTIGKEIT BIS ZUR DIGITALISIERUNG – AMAG PUNKTET MIT FÜNF AWARDS IM OKTOBER

- AMAG ausgezeichnet mit SDG-Award, Green Business Data Award, ALC-Award, Effective Sustainability Communication Award und Best Business Award

- Auszeichnungen für Engagement in Nachhaltigkeit, Digitalisierung und verantwortungsbewusste Unternehmensführung

- Verleihung der Auszeichnungen im Oktober 2023

TEAM DER AMAG RADELT EINMAL UM DIE WELT

- Team der AMAG radelt mehr als 46.000 Kilometer und leistet einen Beitrag für den Klimaschutz

- Gefahrene Strecke spart mehr als 8.100 Kilogramm CO2 ein

- AMAG-Team sichert sich ersten Platz bei der landesweiten Bewertung der Initiative „Oberösterreich radelt“

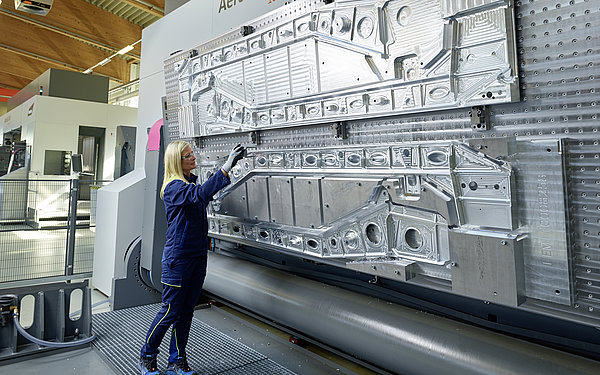

AMAG: INVESTITION IN MODERNE BEARBEITUNGSZENTREN FÜR DIE LUFTFAHRTINDUSTRIE

- Investition in hochmoderne Anlagen zur Bearbeitung von großflächigen Luftfahrtbauteilen

- Masterplan für Wachstum und Effizienzsteigerung an den beiden deutschen AMAG components Standorten in Umsetzung

- Schließung von Materialkreisläufen als Beitrag zur Erreichung der Nachhaltigkeitsziele der Luftfahrtindustrie

AMAG AUSTRIA METALL AG: VORSTANDSVORSITZENDER MAYER SCHEIDET MIT JAHRESWECHSEL AUS DEM UNTERNEHMEN AUS

- Ausscheiden im besten Einvernehmen nach 16 Jahren Vorstandstätigkeit

- Aufsichtsrat hat Prozess der Nachfolgesuche gestartet

AMAG AUSTRIA METALL AG: SOLIDE ENTWICKLUNG IN DEN ERSTEN DREI QUARTALEN 2023 DURCH BREITE AUFSTELLUNG

- Produkt- und Branchenvielfalt sowie Beteiligung an der Elektrolyse in Kanada sichern solide Ergebnisentwicklung in herausforderndem Umfeld

- Anhaltend positiver Trend in der Nachfrage aus der Luftfahrtindustrie; stabile Entwicklung in der Automobilindustrie; Sport- und Architektur-produkte sowie industrielle Anwendungen weiterhin auf niedrigem Niveau

- Umsatzerlöse überschreiten mit 1.142,8 Mio. EUR deutlich 1-Mrd.-EUR-Marke (Q1-Q3/2022: 1.353,9 Mio. EUR)

- EBITDA von 166,0 Mio. EUR infolge einer insgesamt guten Performance in den operativen Segmenten (Q1-Q3/2022: 217,4 Mio. EUR)

- Ergebnis nach Ertragsteuern bei soliden 69,7 Mio. EUR (Q1-Q3/2022: 106,7 Mio. EUR)

- Cashflow aus laufender Geschäftstätigkeit deutlich auf 157,0 Mio. EUR gesteigert (Q1-Q3/2022: 40,5 Mio. EUR)

- Ausblick für GJ 2023: EBITDA-Bandbreite zwischen 175 und 195 Mio. EUR

AMAG MIT ÖSTERREICHISCHEM NACHHALTIGKEITSPREIS AUSGEZEICHNET

- Platz eins für AMAG beim Austrian SDG-Award

- AMAG setzt Nachhaltigkeitsziele der UN bereits seit mehr als einem Jahr-zehnt um

- Preisverleihung im Nationalratssaal des österreichischen Parlaments

AMAG ZUM DRITTEN MAL IN FOLGE FÜR IHRE HERAUSRAGENDE NACHHALTIGKEITSBERICHTERSTATTUNG AUSGEZEICHNET

- Auszeichnung mit dem “Effective Sustainability Communication Award 2023“ bestätigt die ganzheitliche Nachhaltigkeitskommunikation der AMAG

- Erneut Höchstbewertung im integrativen Nachhaltigkeitsverständnis

- Preisverleihung im Rahmen der Jahreskonferenz des Cercle Investor Relations Austria (CIRA) am 11.10.2023 in Wien

AMAG ERNEUERT MEHRJAHRESVERTRAG FÜR WALZPRODUKTE MIT AIRBUS

- Langfristige Absicherung der Liefermengen bei gesteigerten Marktanteilen

- AMAG-Walzprodukte kommen in allen Airbus Flugzeugfamilien zum Einsatz

- Erfolgreiche Partnerschaft zwischen AMAG und Airbus seit 1995

AMAG IST NACHHALTIGSTES ALUMINIUMUNTERNEHMEN DER WELT (BEWERTUNG VON SUSTAINALYTICS)

- AMAG mit einem Top-Ergebnis im Nachhaltigkeitsranking an der Spitze von 39 bewerteten Aluminiumunternehmen weltweit

- Bewertung in den Kategorien Umwelt (Environment), Soziales (Social) und Unternehmensführung (Governance)

- Sustainalytics bewertet 14.000 Unternehmen aus 138 Branchen

ALUREPORT SONDERAUSGABE ESG

Die neue Sonderausgabe des AluReports ist anders als unsere regulären drei Ausgaben pro Jahr. Dieser besonderen Ausgabe zeigt auf, wie wir unsere ESG-Kriterien umsetzen und welche unabdingbaren Maßnahmen und Anstrengungen wir für eine grünere Zukunft unternehmen.

"Alle reden von diesem Dreiklang, nach dem Nachhaltigkeit, ethische Qualität und die sozialen Auswirkungen unternehmerischen Handelns bewertet werden. Wir auch. Denn reden hilft - reicht allein aber natürlich nicht. Deshalb haben wir uns gefragt: Wie setzen wir als AMAG ESG-Kriterien eigentlich um und was braucht es, um diese Konzepte täglich zu leben? Als ganz individuelle Antwort ist diese Sonderausgabe des AMAG AluReports entstanden. Wir ziehen Zwischenbilanz, prüfen und machen sichtbar, wo und wie wir entlang unserer einzigartigen AMAG-Wertschöpfungskette konkret anpacken", so Gerald Mayer, Vorstandsvorsitzender der Austria Metall AG.

AMAG NEUERLICH NACH JAPANISCHEM INDUSTRIESTANDARD ZERTIFIZIERT

- AMAG erhält erneut die JIS-Mark Scheme Zertifizierung („Japanese Industrial Standard“) für Aluminiumprodukte nach JIS H 4000

- JIS steht für höchste Qualität und Zuverlässigkeit

- AMAG erstmalig im Jahr 2020 als erster europäischer Aluminiumproduzent zertifiziert

- AMAG Aluminiumbleche und -platten kommen in Japan hauptsächlich in Schienenfahrzeugen zum Einsatz

AMAG Austria Metall AG: Erfolgreiches 1. Halbjahr mit signifikantem Anstieg im Cashflow

- Breites Produktportfolio, flexible Auftragsabwicklung und rasche Lieferfähigkeit sicherten erfolgreiches 1. Halbjahr 2023. Nachfrage seit Q2/2023 zum Teil deutlich verhaltener

- Umsatzerlöse von 796,4 Mio. EUR nach einem Rekord im Vorjahr (H1/2022: 904,3 Mio. EUR)

- EBITDA spiegelt mit 117,8 Mio. EUR erfolgreiches 1. Halbjahr eindeutig wider (H1/2022: 156,5 Mio. EUR)

- Ergebnis nach Ertragsteuern mit 51,0 Mio. EUR auf erneut attraktivem Niveau (H1/2022: 78,4 Mio. EUR)

- Cashflow aus laufender Geschäftstätigkeit auf 68,0 Mio. EUR deutlich gesteigert (H1/2022: -84,1 Mio. EUR)

- Ausblick 2023: EBITDA zwischen 160 Mio. EUR und 190 Mio. EUR unter der Annahme keiner unerwarteten signifikanten Verschlechterung der Wirtschaftslage sowie einer anhaltend stabilen Aluminiumpreisentwicklung

AMAG mit gesamtheitlichem Nachhaltigkeitsansatz erneut im globalen Spitzenfeld der Industrie

- EcoVadis zeichnet AMAG 2023 erneut mit dem höchsten Status „Platin“ aus

- AMAG in der Gesamtwertung im obersten Prozent („Top 1%“) der von EcoVadis beurteilten globalen Unternehmen in der Branche

- Auszeichnung ist weitere Bestätigung für den gesamtheitlichen Nachhaltigkeitsansatz der AMAG

AMAG erhält erneut „Accredited Supplier“-Award von Airbus

- Airbus verlieh AMAG wiederholt die höchste von vier Qualitätsauszeichnungen

- AMAG ist damit aktuell der einzige Lieferant von Walzprodukten, der auf dieser Stufe bereits zweimal ausgezeichnet wurde

- Auszeichnung für hervorragende Liefertreue und Produktqualität

- Erfolgreiche Partnerschaft von AMAG und Airbus seit 2005

AMAG Austria Metall AG: Erfolgreicher Start ins Jahr 2023

- Solide Auftragsentwicklung und positive operative Performance ermöglichten sehr guten Start ins Jahr 2023

- Umsatz auf 404,8 Mio. EUR leicht gesteigert (Q1/2022: 399,0 Mio. EUR)

- Starkes EBITDA von 60,8 Mio. EUR nach einem Rekord-Quartalsergebnis im Vorjahr (Q1/2022: 68,0 Mio. EUR)

- Ergebnis nach Ertragsteuern mit 26,8 Mio. EUR erneut auf hohem Niveau (Q1/2022: 32,5 Mio. EUR)

- Solider Cashflow aus laufender Geschäftstätigkeit von 35,6 Mio. EUR (Q1/2022: -130,3 Mio. EUR)

- Ausblick 2023: Vorbehaltlich anhaltend solider Markt- und Wirtschaftsentwicklungen und einer gesicherten Energieversorgung ist aus heutiger Sicht ein EBITDA zwischen 170 Mio. EUR und 210 Mio. EUR für das Geschäftsjahr 2023 zu erwarten

NEUE HÖCHSTWERTE BEI UMSATZ UND ERGEBNISKENNZAHLEN IM GESCHÄFTSJAHR 2022

• Erfolgskurs fortgesetzt und Herausforderungen mit hoher Produktivität und Flexibilität sowie stabiler Produktion begegnet

• Umsatzerlöse um 37 % auf 1.726,7 Mio. EUR signifikant gewachsen (2021: 1.259,4 Mio. EUR)

• Deutlicher EBITDA-Anstieg um 33 % auf 247,1 Mio. EUR bei Ergebnis-zuwachs in allen operativen Segmenten (2021: 186,2 Mio. EUR)

• Ergebnis nach Ertragsteuern mit einer Steigerung um +69 % auf 109,3 Mio. EUR erstmals im dreistelligen Bereich (2021: 64,6 Mio. EUR)

• Cashflow aus laufender Geschäftstätigkeit um rund 90 % auf 86,1 Mio. EUR deutlich gesteigert (2021: 45,6 Mio. EUR)

• Dividendenvorschlag von 1,50 EUR je Aktie

NEUER KRANWAGEN BEI AMAG-BETRIEBSFEUERWEHR IM EINSATZ

- AMAG Betriebsfeuerwehr erweitert Fahrzeugflotte mit einem hochqualitativ ausgestatteten Kranwagen

- Kranwagen ist in großen Höhen und schwer zugänglichen Stellen einsetzbar

- Fahrzeug im Anlassfall auch in Braunau und Umgebung einsatzbereit

„Ein neuer Platz zum Ausruhen“ – AMAG Sozialpreis für die Werkstätte des Diakoniewerks in Mauerkirchen

- Werkstätte des Diakoniewerks in Mauerkirchen erhält im Rahmen des AMAG-Sozialpreises neue Sitzgelegenheiten im Aufenthaltsraum

- Platz für Pausen, zum Entspannen und Kommunizieren für 63 Klientinnen und Klienten

- AMAG unterstützte im Rahmen des Sozialpreises und der Sommerkulturinitiative heuer zahlreiche Projekte in der Region

AMAG: Rad-und Fußgängerübergang in Betrieb

- Rad-und Fußgängerübergang zur sicheren Überquerung der B156 fertiggestellt

- Brücke konstruiert mit Holz aus dem AMAG-Wald

- Gesamtbudget: 1,5 Millionen Euro

- Projektumsetzung mit Firmen aus dem Bezirk Braunau

- Das Projekt wurde finanziell durch das Land Oberösterreich, dem Bundesministerium für Landwirtschaft, Regionen und Tourismus sowie der EU unterstützt

- Auszeichnung „klimaaktiv mobil“ erhalten

AMAG setzt Impulse für Radfahren, und das sicher

- Verlosung von zwei E-Bikes aus der Region sowie 150 Fahrradhelmen

- Inbetriebnahme des neuen Fahrrad- und Fußgängerübergangs steht unmittelbar bevor

AMAG als vorbildlicher Lehrbetrieb ausgezeichnet

- AMAG erhält „ineo“- Award und Gütesiegel

- Mehr als 70jährige Erfahrung in der Lehrlingsausbildung

- Neun Lehrberufe werden in der AMAG ausgebildet

Willkommen auf der neuen modernen und nachhaltigen Homepage der AMAG!

- AMAG Homepage präsentiert sich im neuen Design

- Nachhaltigkeit durch energiesparende Darstellung

- Industrie- und Produktbereich der AMAG strukturiert und übersichtlich dargestellt

AMAG erhält Best Business Award in Bronze für nachhaltige Unternehmensführung

• AMAG erhält länderübergreifende Auszeichnung

• AMAG überzeugte unter anderem mit hoher Kompetenz im Recycling, nachhaltiger Produktion und klarer Ausrichtung auf Innovation

• Fachjury bewertete anhand eines umfangreichen mehrstufigen Beurteilungsverfahrens

AMAG Austria Metall AG: Erfolgskurs im 3. Quartal 2022 fortgesetzt

• Umsatzerlöse um 47 % auf 1.353,9 Mio. EUR beträchtlich gesteigert (Q1-Q3/2021: 923,8 Mio. EUR)

• EBITDA-Anstieg um 48 % auf 217,4 Mio. EUR stellt historischen Höchstwert dar (Q1-Q3/2021: 146,5 Mio. EUR)

• Ergebnis nach Ertragsteuern um 87 % auf 106,7 Mio. EUR signifikant gewachsen (Q1-Q3/2021: 57,0 Mio. EUR)

• Optimierter Produktmix und sehr gute Nutzung vorhandener Kapazitäten an Anlagen und Personal sowie stabile Produktion ausschlaggebend

• Weiterer Geschäftsverlauf zunehmend von teilweise rückläufiger Nachfrage und genereller Markteintrübung sowie hohen Energiepreisen beeinflusst

• Ausblick 2022: EBITDA zwischen 230 Mio. EUR und 250 Mio. EUR basierend auf aktuellen Einschätzungen zu Absatz- und Preisentwicklungen sowie eine stabile Energieversorgung vorausgesetzt

• Mittel- und langfristig weiterhin solide Wachstumserwartung nach Aluminiumprodukten*

*Vgl. CRU Aluminium Market Outlook, Oktober 2022

Marienhof-Wirt übernimmt die Leitung des AMAG Restaurants und verwöhnt die Belegschaft künftig mit regionalen Gaumenfreuden

• Reinhard Stockinger (früher Marienhof Kirchdorf) wird ab Jahresbeginn neuer Küchenchef des AMAG Werksrestaurants

• Ausrichtung auf Qualität, Regionalität, Ausgewogenheit und Gesundheit

• Ausweitung des kulinarischen Angebots für AMAG Mitarbeiterinnen und Mitarbeiter

AMAG erneut für herausragende Nachhaltigkeitsberichterstattung ausgezeichnet

• Die AMAG erhielt zum zweiten Mal den “Effective Sustainability Communicator Award 2022“

• AMAG erzielt Höchstwerte im integrativen Nachhaltigkeitsverständnis im ATX Prime Market und belegt insgesamt Platz 2

• Feierliche Übergabe der Auszeichnung im Rahmen der Jahreskonferenz des Cercle Investor Relations Austria (CIRA) am 12.Oktober 2022 in Wien

AMAG erhielt „Juwel“ für nachhaltige Digitalisierung

• Auszeichnung für AMAG und ACP Cubido von ICT Austria für „Sustainable Digitalization“ im Bereich „Data Science“

• Kombination von IT-Lösungsansätzen hat zu sehr erfolgreichen Neuentwicklungen und Optimierungen in der AMAG geführt

• Digitalisierung und Kreislaufwirtschaft sind Innovationstreiber für die profitable Entwicklung der AMAG

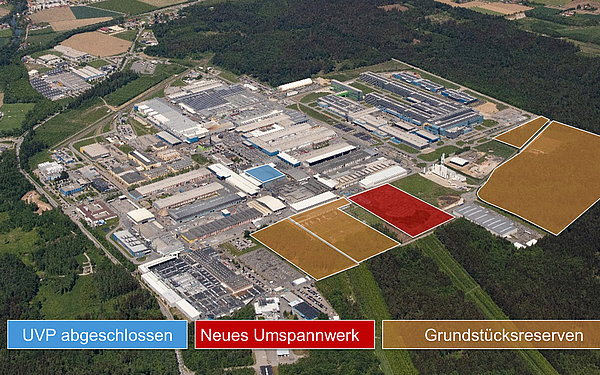

AMAG schafft mit Grundstückserweiterung und abgeschlossenem UVP-Verfahren Grundlagen für strategische Entwicklung des Standorts Ranshofen

- UVP-Verfahren zur Erweiterung der AMAG Gießerei nach 3,5 Jahren mit antragsgemäßer Genehmigung erfolgreich abgeschlossen

- Neubau des AMAG Umspannwerks bildet Voraussetzung für langfristige Entwicklung und Dekarbonisierung des Standorts

- Mit jüngstem Grundstückskauf stockt AMAG die strategischen Grundstücksreserve auf 25 Hektar auf

- Grundstücke ideal positioniert zur Erweiterung der Recyclingaktivitäten

AMAG: Montage der Fahrrad- und Fußgängerbrücke über die B156

- Montage der Fahrradbrücke bei der AMAG Werkseinfahrt am 3.Oktober 2022

- Totalsperre der B156 am 3.Oktober 2022 ab 18:00 Uhr (bis ca. 24:00 Uhr)

- Temporäre Verkehrsanhaltungen am 3., 4. und 5. Oktober 2022

- Forstarbeiten entlang der B156

Auszeichnung für AMAG mit dem Energy Globe Oberösterreich 2022

- AMAG erhält Energy Globe Oberösterreich in der Kategorie „Feuer“ für Österreichs größte Aufdach-Photovoltaikanlage

- Auszeichnung ist eine weitere Bestätigung für den gesamtheitlichen Nachhaltigkeitsansatz der AMAG

Für die Helden auf vier Pfoten – AMAG Sozialpreis für Suchhundestaffel des Braunauer Roten Kreuzes

- Suchhundestaffel des Roten Kreuzes Braunau erhält im Rahmen des AMAG-Sozialpreises Ausrüstung zur Erleichterung der Einsätze

- Übergabe in der AMAG mit Live-Vorführung

- Ehrenamtlicher Einsatz mit jahrelanger intensiver Ausbildung der Zwei- und Vierbeiner

AMAG unterstützt Buchprojekt: "Flora des Innviertels“ beschreibt 2.228 Pflanzenarten

- Autor Prof. Michael Hohla untersuchte 25 Jahre lang akribisch die Pflanzenwelt des Innviertels und fasste die Ergebnisse in einem Standardwerk zusammen

- AMAG unterstützt Projekt und stellt mittleren und höheren Schulen und Gemeinden im Innviertel ein Exemplar zur Verfügung

- Buchpräsentation am 8. September 2022 in der AMAG mit Tour durch das Werk und den AMAG-Wald

AMAG Sommerkulturinitiative 2022 voll im Laufen

- Mit einem Gesamtbudget von 20.000 EUR werden 36 Veranstaltungen im Umfeld des Unternehmens unterstützt

- Ehrenamtliches Engagement der AMAG Mitarbeiter:innen wird honoriert

- Bereits zahlreiche...

Weltneuheit: AMAG und Audi bringen Alurad aus Recycling-Aluminiumlegierung in Serie

- AMAG entwickelte weltweit einzigartige, recyclingfreundliche Legierung AlSi7.REC für Räder und Radwerke

- Markteinführung für zwei Audi Elektrofahrzeuge bereits erfolgt

- Produkt fällt unter die neue ...

AMAG Austria Metall AG: Höchstes Halbjahresergebnis in der Unternehmensgeschichte

- AMAG erzielt Rekordwerte bei Umsatz- und Ergebniskennzahlen im 1. Halbjahr 2022

- Ein positives Marktumfeld, eine anhaltend hohe Produktivität sowie kontinuierliche Produktmixoptimierung ausschlaggebend

- Umsatzerlöse um rund 50 % auf...

AMAG und thyssenkrupp Aerospace verlängern ihre Zusammenarbeit

- AMAG unterzeichnet Halbjahresvertrag mit thyssenkrupp Aerospace

- Zusammenarbeit besteht seit Anbeginn der AMAG-Luftfahrtgeschichte

- thyssenkrupp Aerospace schätzt hohen...

AMAG erweitert größte Aufdach-Photovoltaikanlage Österreichs

- Erweiterung der bestehenden Aufdach-Photovoltaikanlage auf 60.000 m² (entspricht Fläche von 9 Fußballfeldern)

- Jährliche Energieproduktion von 7,3 GWh (Energiebedarf von rund 2.000 Haushalten) für den Eigenbedarf

- Weiteren Schritt für die AMAG-Strategie zur Klimaneutralität...

Neue Produktlinie AMAG AL4®ever mit garantiert niedrigem CO2-Fußabdruck

- AMAG AL4®ever steht für Aluminiumprodukte mit garantiert niedrigen CO2-Emissionen bei unverändert hoher Qualität

- Langjährige Erfahrung im Recycling in Kombination mit Primäraluminiumproduktion in Kanada als Basis für nachhaltige Vormaterialversorgung

- Zertifikat bestätigt niedrige Emissionswerte von AMAG AL4®ever Produkten

- Garantiert niedrige..,

AMAG erhält Höchstbewertung Platin im Bereich Nachhaltigkeit

- EcoVadis zeichnet AMAG nach einer Goldbewertung im Vorjahr nun mit dem höchsten Status Platin aus

- AMAG in der Gesamtwertung im obersten Prozent („Top 1%“) der von EcoVadis beurteilten globalen Unternehmen in der Branche

- Insbesondere Leistungen im Bereich...

AMAG erneut mit Wiener Börse Preis ausgezeichnet

- AMAG in der Kategorie „Mid Cap“ am 3. Platz

- Besondere Anerkennung für Berichterstattung, Investor Relations-Tätigkeit, Strategie und Management

- Fünfte Auszeichnung seit...

AMAG - Lange Nacht der Forschung

AMAG: Spannende Reise in die Welt des Aluminiums in der Langen Nacht der Forschung

- AMAG öffnet im Rahmen der Langen Nacht der Forschung erstmalig das neue Forschungszentrum CMI sowie die Smart Factory für die Öffentlichkeit.

- Mehr als 350 Besucherinnen und Besucher sind ein Beweis, dass Forschung begeistern kann.

- Lange Nacht der Forschung bot...

„Damit die Chemie stimmt“ – AMAG sponsert OÖ Chemieolympiade

- AMAG Hauptsponsor bei Chemieolympiade-Landeswettbewerb in Braunau

- Landessieger ist Moritz Elsner vom BRG Wels, Vize-Landesmeister Felix Markler vom BRG Braunau

- AMAG fördert angehende...

AMAG Smart Factory: vollautomatische Materialprüfung für höchste Sicherheit im Flugzeug und Auto

- 10 Mio. EUR Investition zum Einstieg in die künstliche Intelligenz mit selbstlernenden Maschinen

- Höchste Qualitätsstandards und Effizienz durch digitalisierte Prüftechnologie

- Voll automatisierte Prüfung von...

AMAG Austria Metall AG: Rekordergebnis im 1. Quartal 2022

- Ausgezeichneter Start ins Jahr 2022 mit hohen Unsicherheiten für den weiteren Jahresverlauf

- Umsatz um 60 % auf 399,0 Mio. EUR gewachsen (Q1/2021: 251,2 Mio. EUR)

- EBITDA mit 68,0 Mio. EUR mehr als verdoppelt (Q1/2021: 30,3 Mio. EUR)

- Ergebnis nach Ertragsteuern auf 32,5 Mio. EUR in etwa versechsfacht (Q1/2021: 5,1 Mio. EUR)

- Positive operative Entwicklung mit hoher Produktivität bei...

Mehrjährigen Großauftrag von Ruag Aerostructures erhalten

- AMAG components unterzeichnet Mehrjahresvertrag zur Lieferung von Bauteilen und Komponenten vornehmlich für den Airbus A320

- Langjährige Kundenbeziehung wird damit vertieft und ausgeweitet

- Synergien aufgrund eines einzigartigen...

Gewinner der AMAG Impflotterie erhielt Elektroauto

- AMAG Impflotterie erfolgreich durchgeführt

- B&C Industrieholding finanziert Hauptpreis, einen vollelektrischen VW ID3

AMAG unterstützt den Katastrophenhilfsdienst des Roten Kreuzes im Bezirk Braunau

- Dreijährige Kooperationsvereinbarung abgeschlossen

- Unterstützung des Katastrophenhilfsdienstes im Bezirk mit 10.000 EUR pro Jahr

- Übergabe der Kooperationsurkunde

AMAG spendet Arbeitsgewand für Ukrainehilfe

- AMAG spendet hochwertige Arbeitskleidung an die Volkshilfe

- Sachspende im Wert von 60.000 EUR

- Arbeitskleidung wird dringend zur Ausstattung von Hilfskräften und Flüchtlingen benötigt

AMAG errichtet Rad- und Fußgängerübergang für mehr Sicherheit

- Bau eines Rad- und Fußgängerübergangs über die B156

- AMAG Gesamtbudget: 1,5 Millionen Euro

- Einbindung des Industriegeländes in das überregionale Radwegenetz

- 2021: Bestes Arbeitssicherheitsjahr in der AMAG

- Sicherheitsbewusstsein reicht über Werksgrenzen hinaus

AMAG unterstützt die Forschung für additive Fertigung an der TU Graz mit Hightech-Anlage

- AMAG nach Akquisition seit 1,5 Jahren in der Komponentenfertigung tätig

- Heutige AMAG components ist Spezialist in der mechanischen Bearbeitung und forscht seit 2018/19 an der additiven Fertigung

- Schenkung einer hochmodernen Anlage zur additiven Fertigung an die TU Graz zur Förderung der Forschung und Ausbildung

- Schenkungsvertrag wurde am 15. März 2022 an der TU Graz unterzeichnet

Süße Faschingsdienstags-Überraschung bei der Werkseinfahrt

- 2.600 Faschingskrapfen bei der Werkseinfahrt verteilt

- AMAG unterstützt mit dieser Aktion den Kiwanis Club Braunau

- Frisch vom Bäckermeister aus der Region – Förderung der lokalen Wertschöpfung

Rekordergebnis im Geschäftsjahr 2021 und Absatzmengenanstieg auf Vorkrisenniveau

- Signifikante Steigerung bei Umsatz- und Ergebniskennzahlen durch stabile Produktion, hohe Produktivität und attraktives Marktumfeld bei Primäraluminium

- Umsatzerlöse mit 1.259,4 Mio. EUR infolge gesteigerter Absatzmengen und hohem Aluminiumpreis klar über dem Vorjahresniveau (2020: 904,2 Mio. EUR)

- EBITDA um +72 % auf 186,2 Mio. EUR signifikant gewachsen (2020: 108,2 Mio. EUR)

- Ergebnis nach Ertragsteuern mit 64,6 Mio. EUR fast versechsfacht (2020: 11,1 Mio. EUR*)

- Dividendenvorschlag von...

Vertragsverlängerung von CEO Gerald Mayer und COO Helmut Kaufmann

- Vorzeitige Vertragsverlängerung von Vorstandsvorsitzendem Gerald Mayer und Technikvorstand Helmut Kaufmann

- Beide seit 2007 im AMAG-Vorstand tätig

- Kontinuität im Wachstumskurs der AMAG Austria Metall AG damit sichergestellt

Hochwertige und praktische Jacke für die gesamte Belegschaft

Die AMAG überraschte alle Mitarbeiterinnen und Mitarbeiter mit hochwertigen Multifunktionsjacken. Im einzigartigen und modernen AMAG-Design in der blauen Firmenfarbe schützt die leichte und praktische Jacke sehr gut vor Wind und Wetter bei jeglicher Freizeitaktivität. Auch hierbei wurde Wert auf High-Tech und regionale Beschaffung gelegt. Produziert wurden die mehr als 2.200 Jacken bei Firma Löffler in Ried im Innkreis.

Mit dem Zukauf im Innviertel leistet die AMAG auch einen Beitrag zur Förderung der...

„AMAGicTree“ – AMAG schenkt Mitarbeitern Christbäume zu Weihnachten

- Als Ersatz für die Weihnachtsfeier, die aufgrund von COVID-19 ausfallen musste, bekommen alle AMAG-Mitarbeiter einen Christbaum

- AMAG legt auch hier besonderen Wert auf Regionalität und die Einhaltung der COVID-19-Maßnahmen bei der Verteilung

AMAG schließt Übernahme der deutschen Aircraft Philipp ab

Die AMAG Austria Metall AG erwirbt nach Einstieg im Oktober 2020 nun die

verbleibenden 30 Prozent an der deutschen Aircraft Philipp (ACP) mit Sitz in Übersee

am Chiemsee und wird damit ab Jahreswechsel zur Alleineigentümerin. Mit der

vollständigen Übernahme ändert sich künftig auch der Firmenname auf

AMAG components.

AMAG und B&C investieren über eine Million EURO an der Montanuniversität Leoben

- Kooperationsvertrag für sieben Jahre abgeschlossen

- AMAG und B&C investieren in weiteren Ausbau der Aluminiumforschung in Österreich

- Unterstützung bei der Ausbildung von Spitzenforschern

AMAG Austria Metall AG erzielt Rekordergebnis in den ersten drei Quartalen 2021

- Umsatzerlöse durch höhere Absatzmengen und attraktiven Aluminiumpreis auf 923,8 Mio. EUR deutlich gesteigert (Q1-Q3/2020: 673,2 Mio. EUR)

- EBITDA liegt mit 146,5 Mio. EUR klar über dem Vorjahr (Q1-Q3/2020: 79,8 Mio. EUR)

- Ergebnis nach Ertragsteuern mit 57,0 Mio. EUR gegenüber dem...

AMAG für beste Nachhaltigkeitsberichterstattung im ATX Prime ausgezeichnet

- AMAG ist "Effective Sustainability Communicator 2021"

- AMAG überzeugt mit ganzheitlicher und transparenter Nachhaltigkeitsberichterstattung

- Feierliche Übergabe der Auszeichnung im Rahmen der Jahreskonferenz des Cercle Investor Relations Austria (CIRA) am 13.10.2021 in Wien

AMAG Sozialpreis 2021: Klettergerüst für Volksschule Munderfing

- Übergabe des Klettersechsecks an die Volksschule Munderfing

- Projekt des AMAG Sozialpreises 2021

- Spielgerät ermöglicht Kindern Bewegung und Spaß im Freien

AMAG Sozialpreis 2021: Spürnasenecke für Kindergarten Handenberg

- Übergabe der Spürnasenecke an den Kindergarten Handenberg

- Forschungslabor für Kindergartenkinder, Fortbildung für Pädagoginnen

- Labor fördert vor allem den Bildungsbereich Mathematik, Informatik, Naturwissenschaft und Technik - kurz MINT

Verlängerung des Vertrags von Vertriebsvorstand Victor Breguncci

- Vorzeitige Vertragsverlängerung um weitere 4 Jahre

- Vertriebsvorstand seit Juni 2019

- Kernaufgaben: Strategische Entwicklung bestehender und neuer Märkte,

Optimierung des Produktportfolios

AMAG präsentiert Weg zur Klimaneutralität und nimmt Österreichs größte Aufdach-Photovoltaikanlage in Betrieb

- AMAG bekennt sich zu den Klimazielen Österreichs und zu einer klimaneutralen Produktion im Jahr 2040

- Verstärktes Recycling, Energieeffizienz und der Ersatz fossiler Brennstoffe als Schlüssel zur Zielerreichung auf Unternehmensseite

- Die Politik muss Rahmenbedingungen für eine stabile Versorgung mit grüner Energie zu wettbewerbsfähigen Preisen rechtzeitig sicherstellen

- Inbetriebnahme der größten Aufdach-Photovoltaikanlage Österreichs mit 55.000 m² Kollektorfläche ist weiterer Meilenstein am Weg zur Klimaneutralität der AMAG

AMAG unterstützt Palliativarbeit des Roten Kreuzes in Braunau

- Anschaffung von drei Elektroantrieben für Rollstühle im Wert von 4.300 Euro

- Siegerprojekt beim AMAG Sozialpreis 2021

- Dotierung AMAG Sozialpreis 2021: 24.000 Euro für fünf soziale Projekte in der Region

AMAG Austria Metall AG mit Rekord-Ergebnis im 1. Halbjahr 2021

- AMAG ist bestens gerüstet aus der Krise gestartet und nützte die positive Nachfrageentwicklung zur Steigerung der Absatzmenge in allen Segmenten

- Stabile Produktion mit sehr guter Performance bei Arbeitssicherheit (TRIFR*: 0,28)

- Umsatz- und Ergebniszahlen deutlich über Vorkrisenniveau

- Umsatzerlöse preis- und mengenbedingt auf

Erster grüner Strom aus Österreichs größter AufdachPhotovoltaikanlage

- Planmäßiger Projektfortschritt bei der größten AufdachPhotovoltaikanlage Österreichs - Teilbetrieb aufgenommen

- Erster Teilabschnitt erzeugte bereits 30.000 kWh Strom in den ersten Juniwochen

- Grüner Strom auch zum Laden von Elektroautos

AMAG mit Wiener Börse Preis ausgezeichnet

- Erster Platz in der Kategorie „Mid Cap“ geht an AMAG

- AMAG erzielt Höchstwerte bei den Kriterien Finanzberichterstattung und Investor Relations sowie Strategie und Unternehmensführung

- Feierliche Übergabe in der Wiener Börse

AMAG liefert zertifiziert nachhaltiges Aluminium an Audi

- Erstes ASI-zertifiziertes Aluminium der AMAG wird im Audi A6 Avant eingesetzt

- Erstmalige Außenhaut-Lieferung der AMAG für die Audi A6 Modellreihe

- Mit dem Einsatz von ASI-Material setzen AMAG und Audi wiederum einen gemeinsamen Schritt im Sinne einer nachhaltigen Zukunft

500.000 neue „Mitarbeiterinnen“ schwärmen für die AMAG

- AMAG schafft neuen Lebensraum für 10 Bienenvölker

- Kooperation mit Bienenzuchtgruppe Oberösterreich-Salzburg zur Züchtung milbenresistenter Bienen

- Stärkung der Artenvielfalt und Förderung der Biodiversität als Bestandteile der AMAG-Nachhaltigkeitsstrategie

- Weltbienentag am 20.05.2021 als Starttermin für die „AMAG-Bienen“

AMAG: Tolle Tafel begeistert Schülerinnen und Schüler

- AMAG Digitalisierungsinitiative mit Übergabe von modernen Whiteboards erfolgreich abgeschlossen

- Schülerinnen und Schüler nutzen die „tollen Tafeln“ bereits im Unterricht

- Schulen bestätigen den Nutzen der zur Verfügung gestellten Geräte

AMAG: Projektstart für die größte Aufdach-Photovoltaik-Anlage Österreichs

- Projektstart am 21.04.2021 erfolgt, Fertigstellung im Q4/2021 geplant

- Größte Aufdach-Photovoltaikanlage wird rund 6,7 GWh elektrischen Strom pro Jahr liefern

- Projekt im Einklang mit den österreichischen und europäischen Klimazielen

- Projektfortschritt kann über Live-Webcam verfolgt werden

AMAG Austria Metall AG mit positiver Ergebnisentwicklung im 1. Quartal 2021

- Generell positives Marktumfeld in allen AMAG-Segmenten. Nur Luftfahrt erwartungsgemäß auf niedrigem Niveau

- Umsatzerlöse auf 251,2 Mio. EUR gesteigert (Q1/2020: 246,4 Mio. EUR)

- EBITDA in Höhe von 30,3 Mio. EUR nach 36,5 Mio. EUR in Q1/2020

- Rund 11.000 Tonnen Absatzmenge und deren...

AMAG und Audi Hungaria kooperieren beim Recycling von Aluminium

- Audi-Produktionsabfälle werden wieder zu hochwertigen Aluminiumhalbzeugen verarbeitet

- Geschlossener Materialkreislauf spart Energie und Ressourcen

- Ökologische Win-Win-Situation für beide Vertragspartner

AMAG: Solides Ergebnis in COVID-geprägtem Jahr

- Umsatzerlöse mit 904,2 Mio. EUR mengen-, mix- und preisbedingt unter Vorjahresniveau (2019: 1.066,0 Mio. EUR)

- EBITDA von 108,2 Mio. EUR in herausforderndem Marktumfeld (2019: 143,0 Mio. EUR)

- Erfolgreiche Anpassung der Sach- und Strukturkosten an Auslastungsgrad

- Ergebnis nach Ertragsteuern mit 11,6 Mio. EUR deutlich positiv (2019: 38,6 Mio. EUR)

- Cashflow aus laufender Geschäftstätigkeit mit...

AMAG-Digitalisierungsinitiative: Laptopübergabe an Schulen der Region

- Übergabe der mobilen Endgeräte pünktlich zum Semesterstart

- AMAG unterstützt Schulen mit Digitalisierungsleistungen im Wert von insgesamt rund 60.000 Euro

- Digitalisierung an Schulen weiterhin von hoher Bedeutung

AMAG: Positiver Bescheid im UVP-Verfahren

- OÖ Landesregierung erteilt Genehmigung für Ausbauvorhaben

- Umfassende behördliche Auseinandersetzung mit Projektauswirkungen in 18-monatigem Umweltverträglichkeitsprüfungsverfahren

- Erweiterungsprojekt dient der strategischen Weiterentwicklung als Leitbetrieb der Region

AMAG erhält erneut Gütesiegel für betriebliche Gesundheitsförderung

- Auszeichnung zum fünften Mal in Folge erhalten

- AMAG überzeugt bei allen bewerteten Kriterien

- Flexible Reaktion auf pandemiebedingte Herausforderungen

- Mitarbeiterinnen und Mitarbeiter profitieren von umfangreichem Leistungsangebot

AMAG beendet Kurzarbeit mit Jahreswechsel

- Ende der Kurzarbeit mit 31.12.2020

- Erfreuliche Entwicklung der Auftragseingänge

- Neue Mitarbeiterinnen und Mitarbeiter ab Beginn des nächsten Jahres gesucht

Nachhaltigkeit: AMAG erhält Gold-Zertifizierung

- AMAG erreicht Gold-Status im EcoVadis-Nachhaltigkeitsrating

- AMAG gehört zu den besten 2% derBranche

- Experten unterstreichen besondere Stärke in den Bereichen Umwelt sowie Arbeits-und Menschenrechte

AMAG unterstützt Schulen bei Digitalisierung

- AMAG unterstützt Schulen mit Digitalisierungsleistungen im Wert von 50.000 Euro

- Unterstützung geht an Schulen in Braunau, Neukirchen und Ranshofen

- Digitalisierung in den Schulen gewinnt an Bedeutung

Planmäßige Fertigstellung der Lärmschutzinvestition

Wie bereits im September angekündigt, konnten die Bauarbeiten an der neuen Schrottlagerhalle, die zum Schutz der Nachbarschaft vor Geräuscheinwirkungen errichtet wurde, planmäßig im November abgeschlossen werden. Mit 1. Dezember wurde die neue Halle nun in Betrieb genommen.

AMAG errichtet Österreichs größte Aufdach-Photovoltaikanlage

Auf einer Fläche von 55.000 m², das entspricht etwa acht Fußballfeldern, errichtet die AMAG die größte Aufdach-Photovoltaikanlage Österreichs. Das Investitionsvolumen dieses Projektes beläuft sich dabei auf mehrere Millionen Euro. Pro Jahr erzeugt die Anlage, die sich auf den Dächern des neuen Werks befinden wird, rund 6 GWh Strom. Das entspricht dem Verbrauch...

AMAG Betriebsfeuerwehr nimmt hochmodernes Löschfahrzeug in Betrieb

Die AMAG-Betriebsfeuerwehr ist mit einer Mannschaftsstärke von rund 100 Kameradinnen und Kameraden und modernstem Gerät ein Garant für Sicherheit im Einsatz- und Krisenfall. Die Fahrzeugflotte wurde nun um ein hochmodernes Löschfahrzeug erweitert, das durch seine Ausstattung nicht nur die Wasserversorgung im Brandfall sicherstellt: Auch für Auspumparbeiten, zum Be- und Entlüften sowie bei der Höhen- und Tiefenrettung wird der Neuerwerb zum Einsatz kommen. Neben Einsätzen...

AMAG-Sozialpreis: Kinder und Jugendliche wandern mit Alpakas

- AMAG unterstützt Kinder und Jugendliche aus Schloss Neuhaus

- Lehrreiche und spannende Stunden im Alpaka Regenbogenland

- Phantasiereise und Klangschalen zur Entspannung

AMAG Austria Metall AG in Q1-Q3/2020 mit einem EBITDA von 79,8 Mio. EUR

- EBITDA in Höhe von 79,8 Mio. EUR nach 109,2 Mio. EUR in den ersten drei Quartalen des Vorjahres

- Erfreuliche Ergebnisentwicklung im Segment Metall dämpft die COVID-19-Einflüsse im Bereich der Recycling-Gusslegierungen und Aluminium-walzprodukte

- Strukturkosten erfolgreich an Auslastung angepasst. Kurzarbeit wirkt dabei unterstützend

- Ergebnis nach Ertragsteuern aktuell bei...

AMAG erhält ASI-Zertifikat für umfassende Nachhaltigkeitsaktivitäten

- Zertifizierung nach ASI Chain of Custody Standard erweitert AMAG-Nachhaltigkeitsaktivitäten auf Zulieferstruktur

- AMAG bietet seinen Kunden ASI-zertifiziertes Aluminium als weiteren Baustein im AMAG-Spezialitätenportfolio

- Bereits seit 2018 nach ASI Performance Standard zertifiziert

- Nachhaltigkeit ist wesentliche Säule der...

Dachgleiche bei Lärmschutzinvestition

- Lärmmessungen ergaben keine Überschreitung von Grenzwerten

- Freiwilliger Lärmschutz durch Baumaßnahme bei Schrott-Zwischenlager

- Errichtung eines 350 Meter langen Lärmschutzwalls abgeschlossen

AMAG übernimmt Mehrheitsanteil an deutscher Aircraft Philipp Gruppe

- Übernahme eines 70 % Anteils an der Aircraft Philipp Gruppe (ACP) mit Sitz am Chiemsee

- Weiterer Schritt in der Umsetzung der AMAG Spezialitätenstrategie

- ACP ist Experte im Bereich der mechanischen Bearbeitung von Aluminium und Titan für die Luft- und Raumfahrt

- Erweiterungsmöglichkeit des ACP-Leistungsspektrums...

AMAG Austria Metall AG: Solides 1. Halbjahr in schwierigem Umfeld

- COVID-19 hat bedeutenden Einfluss auf die Kundennachfrage, insbesondere in den Bereichen Luftfahrt, Automobil und Handel

- Umsatzerlöse mengen- und preisbedingt mit 463,8 Mio. EUR um 16 % unter dem Vorjahresvergleichswert

- Fix- und Strukturkosten weitgehend an COVID-19-bedingt gesunkene Auslastung angepasst

- EBITDA in Höhe von...

AMAG Forschungskompetenz in neuem Erscheinungsbild

- Neues Forschungszentrum planmäßig für den regulären Betrieb eröffnet

- Steigende Anforderungen an F&E und Prüftechnik durch Werksausbau und zunehmende Spezialisierung

- AMAG-Aufwendung 2019 für F&E: rund 30 Mio. EUR

- 155 Mitarbeiter/-innen (ca. 8 Prozent der Gesamtbelegschaft) im Bereich F&E und Innovation tätig

- Moderne Architektur mit

AMAG unterstützt Begegnungszentrum Braunau

- Unterstützung für das im Aufbau befindliche Begegnungszentrum

- Finanzielle Mittel für die Einrichtung einer Spielecke

- Projekt „Little Children, Big Dreams“ wurde im Rahmen des AMAG-Sozialpreises eingereicht

AMAG erfolgreich nach japanischer Industrienorm zertifiziert

- Erster europäischer Aluminiumproduzent mit JIS-Zertifizierung (Japanese Industrial Standards)

- Erweiterung des Produktportfolios für den japanischen Markt

- Anschaffung einer speziellen Zugprüfmaschine zur Erfüllung der besonderen JIS-Anforderungen

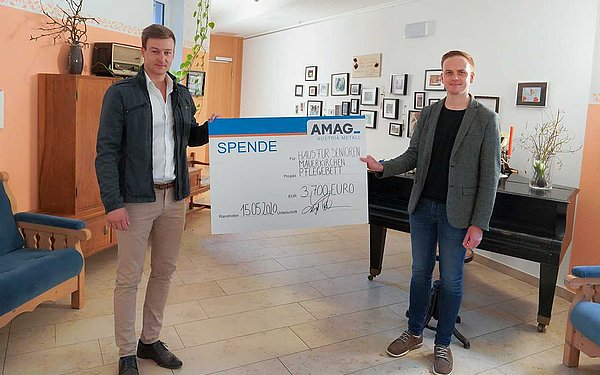

AMAG unterstützt „Haus für Senioren“ in Mauerkirchen

- Projekt Finanzielle Unterstützung für die Anschaffung eines speziellen Pflegebettes

- Projekt wurde im Rahmen des AMAG-Sozialpreises eingereicht

- Unterstützung des durch die aktuelle Krise vor besonderen Herausforderungen stehenden Seniorenheims

AMAG: Ankündigung der ordentlichen Hauptversammlung

- 9. Ordentliche Hauptversammlung für 21. Juli 2020 geplant

- Abhaltung als virtuelle Versammlung

- Dividendenzahltag für 28. Juli 2020 terminiert

- Dividendenvorschlag an Marktumfeld angepasst

Siegerprojekt beim AMAG-Sozialpreis 2020: Verkaufsladen für Bezirksseniorenzentrum Braunau

- Errichtung eines Verkaufsladens für die Senioren des Bezirksseniorenheims Braunau

- Siegerprojekt mit 12.000 EUR dotiert

- In Summe werden rund 25.000 EUR für sechs soziale Projekte in der Region ausgegeben.

AMAG Austria Metall AG erzielt Ergebnisanstieg im 1. Quartal 2020

- Anstieg der Profitabilität im Vergleich zum 1. Quartal des Vorjahres

- Umsatzerlöse mit 246,4 Mio. EUR unter dem Vorjahreswert von 274,4 Mio. EUR

- Anstieg des operativen Ergebnisses (EBITDA) auf 36,5 Mio. EUR vor allem aufgrund niedrigerer Rohstoffkosten (Q1/2019: 33,0 Mio. EUR)

- Ergebnis nach Ertragsteuern mit...

AMAG spendet besonders schwer verfügbare FFP-3 Schutzmasken an Krankenhaus Braunau

- Insgesamt rund 4.000 Schutzmasken gespendet

- Darunter auch besonders schwer verfügbare Masken der höchsten Schutzklassen (FFP-3 und FFP-2)

AMAG-Betriebsfeuerwehr: Erfolgreich im Einsatz für das Unternehmen und die Region

- 2019: 1.000 Arbeitstage bei Einsätzen, Übungen und Unterstützungsleistungen in der Region

- AMAG fördert die kontinuierliche Aus- und Weiterbildung

- 30 Leistungsabzeichen im Jahr 2019 belegen den Erfolg

- Modernste technische Ausstattung und hohe Kompetenz kommen auch dem regionalen Umfeld zugute

Corona-Krise: AMAG führt Kurzarbeit ein

- Auftragsrückgang vor allem aus der Automobilindustrie

- BMI stuft AMAG für die Versorgung der österreichischen Bevölkerung als systemrelevant ein

- Umfangreiche Maßnahmen zum Schutz der Gesundheit der Mitarbeiter und zur Sicherstellung der Produktion umgesetzt

- Ergebnisauswirkung durch die Corona-Krise aktuell noch nicht abschätzbar

(BMI: Bundesministerium für Inneres)

Nominierung Energy Globe Award OÖ

- Investition von rund 3 Millionen EUR in nachhaltiges Regenwassermanagement

- Rund vier Hektar Versickerungsfläche zur Erhaltung des natürlichen Wasserkreislaufes

- Aktiver Beitrag zur Neubildung von wertvollem Grundwasser in der Region

- Der Energy Globe Award ist mit 187 teilnehmenden Ländern der weltweit bedeutendste Umweltpreis

AMAG im Jahr 2019 mit Anstieg beim operativen Ergebnis und Rekorden bei der Cashflow-Entwicklung

- Anstieg beim Absatz um +4 % auf 440.300 Tonnen

- Umsatzerlöse mit 1.066,0 Mio. EUR preisbedingt knapp unter dem Vorjahreswert von 1.101,6 Mio. EUR

- EBITDA-Anstieg auf 143,0 Mio. EUR in einem herausfordernden Marktumfeld (2018: 141,0 Mio. EUR)

- Ergebnis nach Ertragsteuern in Höhe von...

AMAG erhält „Accredited Supplier“-Award von Airbus

Die AMAG hat vom europäischen Flugzeughersteller Airbus im Jänner 2020 in Toulouse, Frankreich, am Airbus Material & Parts Supplier Day den sogenannten „Accredited Supplier“-Award, die höchste von vier Qualitätsauszeichnungen für Lieferanten erhalten. AMAG ist damit auch der einzige Lieferant von Aluminiumwalzprodukten, der diese höchste Auszeichnung erhalten hat. Der Preis wird für hervorragende Liefertreue und ausgezeichnete Produktqualität verliehen...

Leopold Pöcksteiner

Leitung Konzernkommunikation

Tel.: +43 7722 801 2205