AMAG Austria Metall AG reporting record earnings in H1/2021

- AMAG emerged well prepared from the crisis and exploited the positive demand trend to increase shipment volumes across all divisions

- Stable production with very good performance in occupational safety (TRIFR*: 0.28)

- Revenue and earnings figures significantly above pre-crisis level

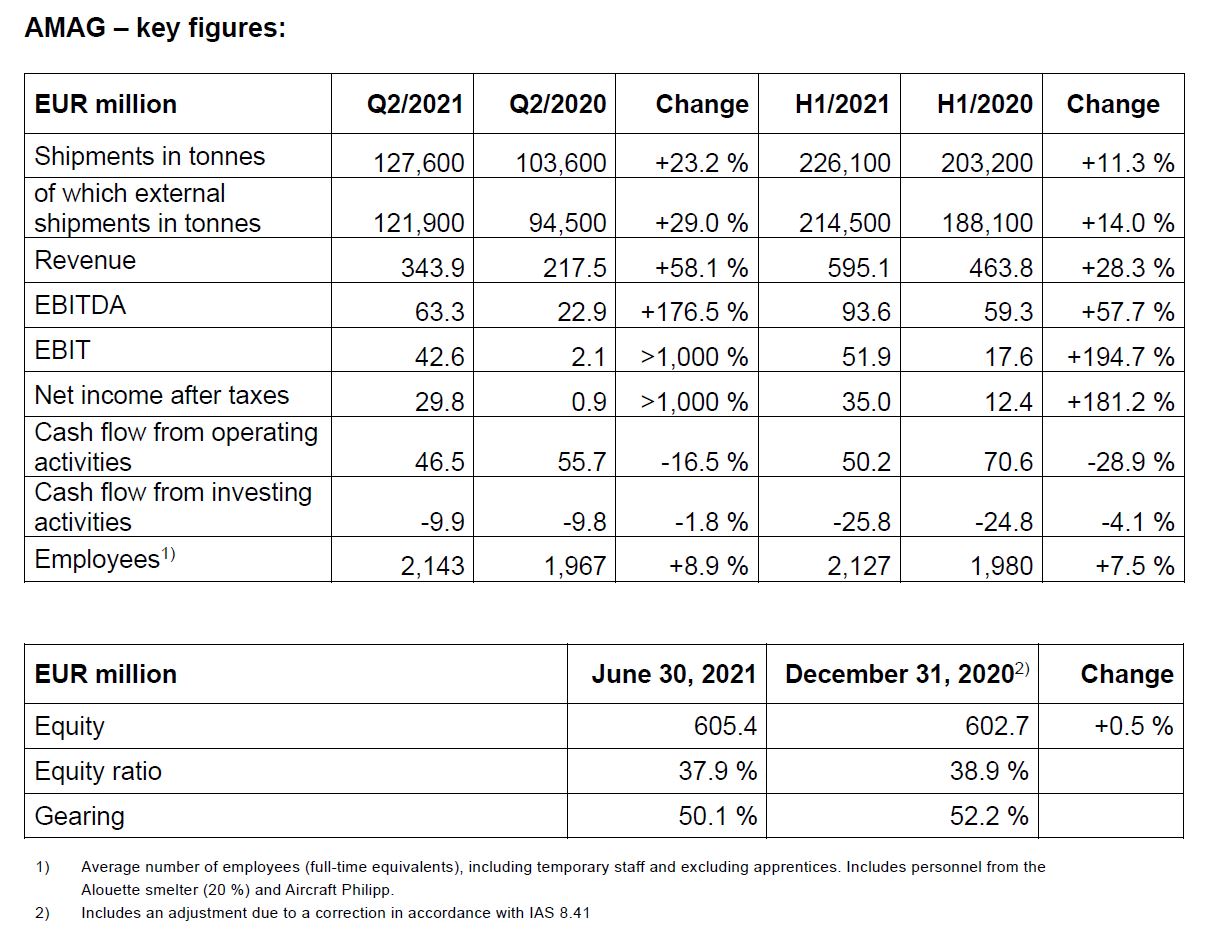

- Revenue increased to EUR 595.1 million due to price and volume factors (H1/2020: EUR 463.8 million)

- Record half-year EBITDA of EUR 93.6 million (H1/2020: EUR 59.3 million)

- Net income after taxes of EUR 35.0 million clearly above the levels of 2020 and 2019 (H1/2020: EUR 12.4 million; H1/2019: EUR 18.9 million)

- Outlook for 2021: Full-year EBITDA between EUR 155 million and EUR 175 million after EUR 108.2 million in the previous year and EUR 143.0 million in FY 2019

*Total Recordable Injury Frequency Rate, based on 200,000 working hours

AMAG Austria Metall AG continued to benefit from the positive market environment after a solid start to the first quarter of 2021. Attractive aluminium prices and premiums, in particular, are providing a noticeable tailwind in the Metal Division. Demand for aluminium rolled products and recycled cast alloys developed positively. As expected, demand from the aircraft industry was low in the reporting period.

Gerald Mayer, CEO of AMAG Austria Metall AG: “We were well equipped for the rapid market recovery, which enabled us to take advantage of the positive economic environment. Due to the attractive price situation in the Metal Division and a gratifying trend in shipments at the Ranshofen site, we not only exceeded the pre-crisis level, but even achieved the best half-year result in AMAG’s history.”

Revenue reflects a positive trend in the aluminium price as well as in shipment volumes. The 3-month aluminium price averaged USD 2,256/t in the period under review, up from USD 1,622/t in the first half of 2020. Shipment volumes reported tangible growth from 203,200 to 226,100 tonnes. Overall, the AMAG Group achieved an increase in revenue from EUR 463.8 million in H1/2020 to EUR 595.1 million in the first half of 2021 (+28.3%).

Earnings before interest, tax, depreciation and amortization (EBITDA) reported significant growth from EUR 59.3 million in the first six months of the previous year to the current figure of EUR 93.6 million. In addition to a stable production in all AMAG divisions, attractive aluminium prices and low raw material costs in the primary aluminium segment were crucial factors in this context. The good performance in terms of new order intake of aluminium rolled products and recycled cast alloys also had a positive impact. In the first half of 2021, significant year-on-year earnings improvements were achieved in all operating divisions of the AMAG Group.

Taking into account depreciation and amortisation of EUR -41.7 million (H1/2020: EUR -41.7 million), the operating result (EBIT) of EUR 51.9 million was also recorded significantly higher than in the previous year (H1/2020: EUR 17.6 million).

Net income after taxes of EUR 35.0 million reflects a successful H1/2021 for the AMAG Group (H1/2020: EUR 12.4 million).

Cash flow from operating activities was solid in the current half-year at EUR 50.2 million (H1/2020: EUR 70.6 million). The high level of earnings had a positive effect. Particularly a significantly higher aluminium price incurred a countereffect. With cash flow from investing activities currently at EUR -25.8 million, compared with EUR -24.8 million in H1/2020, the AMAG Group is reporting a free cash flow of EUR 24.4 million (H1/2020: EUR 45.8 million).

Net financial debt remained at a stable level and stood at EUR 303.3 million as of June 30, 2021 compared with EUR 314.3 million as of the end of the 2020 financial year.

The AMAG Group’s equity also remains solid; at EUR 605.4 million as of June 30, 2021, equity was approximately at par with the EUR 602.7 million at the end of 2020. The equity ratio currently stands at 37.9%, down from 38.9% as of December 31, 2020.

Outlook for 2021:

The overall positive market environment provides grounds for optimism. The price situation in the primary metal sector is attractive and the order book position at the Ranshofen site is gratifying. The current forecasts from Commodity Research Unit (CRU) point to a positive outlook for aluminium demand across all sectors. Both, primary aluminium and aluminium rolled products are expected to expand by around 9 % in 2021.

Gerald Mayer, CEO of AMAG Austria Metall AG: “In view of the current situation we are looking to the second half of the year with optimism. Thanks to the stable smelter operations in Canada, we are benefiting from the positive market environment in the primary aluminium sector. The order book position at the Ranshofen site has reached an all-time high in the last few weeks and leads us to expect a high level of shipments over the coming months. In order to ensure continued growth, we are currently seeking to hire around 50 employees.”

The AMAG Management Board expects an EBITDA of between EUR 155 million and EUR 175 million for the full 2021 financial year, compared with EUR 108.2 million in the previous year and EUR 143.0 million in the 2019 financial year.